Bilateral trade between China and Saudi Arabia has surged in recent years. Since 2013, China has been the largest market for Saudi oil, last year accounting for 21.7 percent of the country’s oil exports. Despite a global trade surplus, China consistently runs a trade deficit with Saudi Arabia.

In recent years, Beijing has made efforts to facilitate the settlement of China-Saudi oil trade in renminbi (RMB) rather than in U.S. dollars, a move that would steel China’s trade from financial sanctions and disrupt the global market for oil. While the RMB represents only 7 percent of total global trade payments, it is used in 23 percent of China’s goods trade. This share has doubled since 2017, according to China’s central bank, the People’s Bank of China (PBOC). If RMB trade with Saudi Arabia is similar to the RMB’s global share of usage in Chinese goods trade, then, at a pace of almost 2 million barrels of Saudi oil per day, it is possible that about 100 billion RMB (U.S.$15 billion) worth of Saudi oil is already being settled in Chinese currency annually. Unfortunately, this calculation is hypothetical. The PBOC does not release a statistic precise enough to confirm the share—if any—of China-Saudi oil trade settled in RMB, and neither the PBOC nor Saudi Arabia’s central bank releases the composition of its foreign exchange reserves, which would offer more conclusive evidence. For 23 percent of all Chinese goods imports to be settled in RMB, it would be surprising if the country’s energy imports, its second largest overall import category, did not contribute to that share.

Regardless of whether China-Saudi RMB-settled oil trade currently totals 100 billion RMB or zero, Beijing has successfully erected the architecture to facilitate future RMB settlement.

De-dollarizing even a portion of Saudi oil trade would help China secure reliable energy flow even in the event of a future crisis, or under the stress of what China’s leader Xi Jinping has characterized as “extreme scenarios.” China’s leaders know that its dollar reserves, like Russia’s, can be frozen, and the holdings and transactions of Chinese firms frozen and blocked. Such moves, perhaps even more so than the similar sanctions on the Russian economy, would place extraordinary stress on China’s economy, which is more complexly intertwined with global trade than Russia’s. Without a reliable way to pay for imports, Beijing might struggle to access commodities useful in wartime.

If China can successfully develop a non-dollar oil trading architecture with Saudi Arabia in the coming years, Beijing may find itself able to withstand financial sanctions directed at China’s oil imports. The more that China-Saudi economic integration facilitates a durable, non-dollar RMB-trade settlement zone, the more insulated China-Saudi trade in oil can be from U.S. financial sanctions—even in a world where the dollar remains dominant globally, and price discovery for oil remains in dollars.

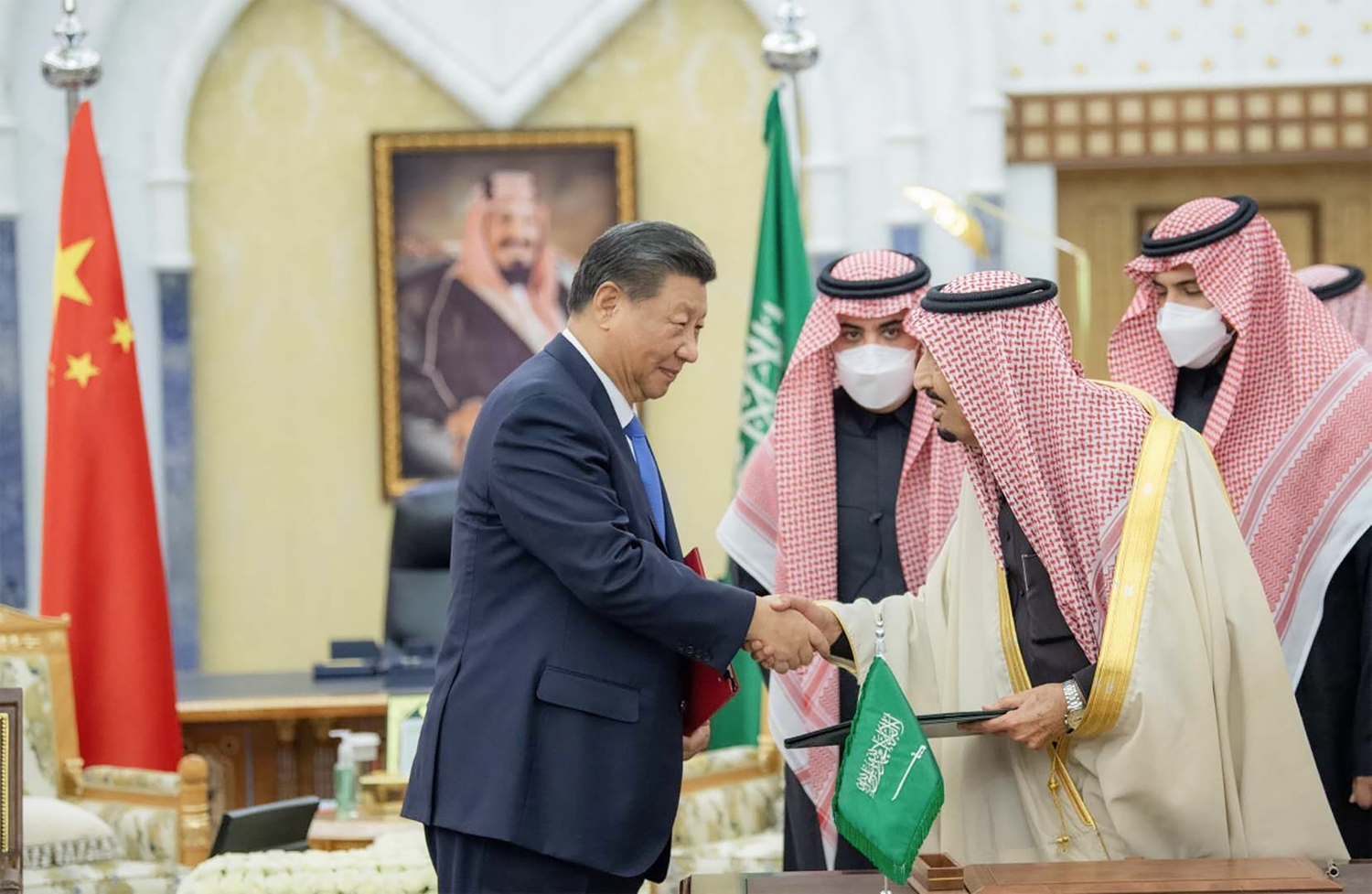

It is with this objective in mind that Xi explicitly asked Saudi leaders to accept RMB settlement. “The Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade,” he said in Riyadh in December 2022. “The two sides could start currency swap cooperation, deepen digital currency cooperation and advance the m-CBDC Bridge project,” the name for the platform designed to facilitate cross-border trade in China’s digital currency.

Saudi leaders have since noted that the Kingdom would consider accepting RMB as a payment currency. The RMB is the fifth most-used international payment currency, second-largest trade financing currency, and the fifth most common currency for FX spot transactions, according to SWIFT, the financial messaging service. The RMB’s share of usage in global trade finance has more than tripled over the past two years, to 5.80 percent of all trade finance, overtaking the euro in September 2023.

Although its total global use lags behind the dollar, euro, and yen, the RMB is easier to use as a settlement currency now than it was just five years ago. The People’s Bank of China has implemented various measures designed to facilitate oil trade in RMB, including opening a bank branch in Riyadh that clears RMB and establishing a commodities exchange, the Shanghai International Energy Exchange, that serves as a working forward market for oil to help traders hedge the RMB exposure necessary for transacting.

Gulf countries supply China with over 5 million barrels of crude oil per day, half of China’s oil imports. If, in the future, China were to pay for all these imports in RMB, Beijing would reduce its overall exposure to U.S. dollars by U.S.$173 billion each year, at the current dollar price of U.S.$90 per barrel. Since this figure is equivalent to 28 percent of China’s RMB-settled trade today, paying for Gulf oil in RMB would mark a notable increase in RMB usage. In other words, while $173 billion amounts to only 6 percent of China’s total annual goods imports, that sum would increase the overall share of Chinese trade settled in RMB from 23 percent to 29 percent, or almost a third of all goods imports.

Beijing and Riyadh would find their growing financial cooperation in RMB naturally reinforced by trade effects, too. As Riyadh settles more of its oil trade in RMB, the Saudi treasury will collect RMB that it will need to spend. Since the derivatives market for RMB is thin, risk management tools are minimal, and trade finance is limited, it would be risky for Saudi Arabia to hold RMB indefinitely. Instead, RMB accumulated from the oil trade must be spent on RMB-denominated Chinese goods and services. Chinese construction contracts would be one likely destination; Chinese firms have been solicited to build Crown Prince Mohammed bin Salman’s new city in the desert, NEOM. This channel, which would facilitate Saudi Arabia’s recycling of RMB, is already well developed; China’s export of goods and services to Saudi Arabia has more than doubled by value since 2018, and China’s share of Saudi imports has increased from 15 to 22 percent over the same period. The need to spend accumulated RMB would provide self-sustaining logic for Saudi Arabia’s participation in Xi’s flagship Belt and Road Initiative, which in 2021 directed 28.5 percent of annual funds into the Middle East and North Africa.

Riyadh can also invest accumulated RMB in projects back in China via financial pathways that Chinese authorities are racing to streamline. Chinese regulators have reportedly approved the application of Saudi Arabia’s sovereign fund, the Public Investment Fund, for Qualified Foreign Institutional Investor status, which would permit the fund to invest directly in the Chinese stock market using RMB. In March of this year, Saudi Arabia’s largest company, oil giant Aramco, purchased a 10 percent stake in a Chinese petrochemicals company and is expanding its refinery footprint along China’s coast. The company may ultimately float a portion of ownership shares on Hong Kong’s exchange.

Development of this relationship will help Beijing financially secure its oil trade at the same time that China’s leaders pursue parallel efforts to secure physical supply lines. While academic consensus has adeptly concluded that it is not the intention of Beijing to seek to displace the dollar’s global role, establishing an RMB trade settlement network that can avoid the pain of U.S. financial sanctions on strategic imports is a priority. Only if Beijing believes its strategic trade is sufficiently insulated from any U.S.-led program of anti-China sanctions can China’s leaders confidently confront U.S. power in the Pacific.