A glass of Feitian Moutai packs a wallop, which is one reason why the 106-proof baijiu is a hit among influential government officials.

They also like Feitian Moutai because a single bottle, thanks to special arrangements between state agencies and distiller Kweichow Moutai Co. Ltd., costs only 619 yuan—less than one-third the retail price.

This price gap is contributing to growing investor concern about the company. Its unusual dealer network and a possible slowdown for government liquor spending are raising red flags as well.

Some say Moutai as a company may be a lot weaker than its baijiu.

State-controlled, Shanghai-listed and Renhuai, Guizhou province-based Moutai has long capitalized on its status as a traditional favorite in China for toasts, business dinners and after-hours imbibing. The company reported net profits rose 73 percent last year from 2010 to 8.8 billion yuan, while operating revenues climbed 58 percent to 18.4 billion yuan.

In the eyes of many minority investors, Moutai is too reliant on discounted sales to government-backed clients.

Those fears were fanned March 26 when Premier Wen Jiaobao suggested the government slash its liquor budget. Speaking at the State Council’s Fifth Clean Governance conference, Wen proposed “prohibiting the use of public funds to buy cigarettes, high-end liquor and gifts.”

The next day, market capitalization worth 14 billion yuan evaporated as Moutai’s stock price fell to 201 yuan from 215 yuan per share.

Critics of Moutai’s business model say too many top-of-the-line bottles of its liquor are sold in bulk at discount prices to buyers affiliated with the state, which also happens to be the company’s majority owner. Moreover, major sales channels are controlled by influential government and business officials with the power to fix prices.

The business restricts the amount of expensive Moutai available for sale at full retail prices, pinching the company’s profit potential.

If government agencies, the military and state-run companies indeed buy less liquor in the future, as Wen suggested, more of Moutai’s best brands may be available for public consumption at full prices. But there’s no guarantee retail sales will offset a slowdown for bulk deals.

The company has tried to boost direct sales and get around a dealer network which includes many high-level officials. It’s also come out with new products aimed at widening the brand’s public appeal. So far, though, it’s had little success, and critics have been crowing louder.

Tangled Dealer Net

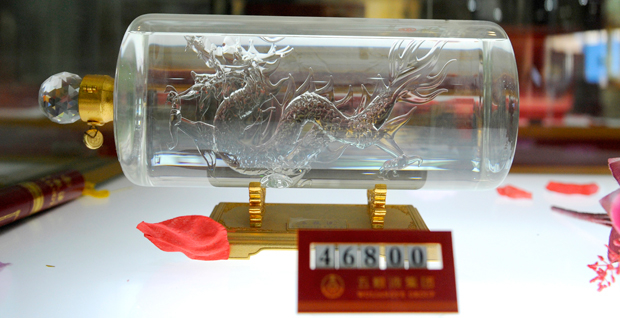

Samples of every type of Moutai liquor—including those collected by connoisseurs—are proudly displayed in an exhibition hall at the company’s distillery in Renhuai.

Distillery tour guides describe for visitors the company’s “important role” in national politics, diplomacy and the economy. They also show off warehoused boxes labeled “special supply,” packed with bottles reserved for big-name buyers.

Cases of the best liquor are set aside, for example, for the Great Hall of the People in Beijing, members of the Chinese People’s Political Consultative Conference (CPPCC), the military’s Central Guard Bureau, the navy’s North Sea Fleet, the Chengdu Military Command, telecom giant China Mobile, and the utility China Southern Power Grid.

Special supplies are never seen in public, as none of the liquor is made available to general retailers.

How much of the company’s output is sold to government buyers remains a mystery. Moutai investor Dan Bin, chairman of Shenzhen Oriental Harbor Investment Co., estimates it’s probably around 7 percent. Company executives have rejected higher estimates as exaggerations.

Dan belongs to a group of Moutai stock investors who say government sales hurt more than help the company. Special-supply buyers “are snatching profits from Moutai,” he said.

The company’s unusual dealer network is also said to be a drag on profits. Although Moutai officially stopped adding new dealers five years ago, an industry source said in fact the network has secretly expanded to include more high-level officials who use their connections to make money selling Moutai.

Moutai has about 1,500 sales offices nationwide, the source said, and they’re run almost exclusively by “rich and powerful people. A Moutai dealers’ conference is like a car show for luxury models.”

The source said he knows one CPPCC member who recently got permission to operate about thirty Moutai sales outlets.

In April, the company announced a marketing adjustment that includes opening “direct-retail stores” around the country. An initial investment of up to 850 million yuan will be used to open thirty-one wholly owned stores in thirty-one provinces, municipalities, and autonomous regions, the company said.

A new subsidiary called Kweichow Moutai Sales Co. Ltd. is in charge of the stores. Thirteen had opened as of December 31, 2011 following a combined investment of about 200 million yuan.

The market interpreted this move as a company attempt to break free from its dealer network and improve its bottom line. In a recent report, analysts at Century Securities praised the adjustment for helping the company meet its goals by cutting out middlemen, boosting revenues at the expense of its dealers, and exercising more price control.

”Retail stores are conducive to protecting the interests of the Guizhou provincial government and investors,” said an industry source. “It also affects dealer interests. Veteran dealers have been with the company through thick and thin, and (Moutai) can’t afford to offend bigwig dealers.”

Price Adjustments

The prime minister’s plan to cut government expense accounts parallels an anti-corruption drive that’s hurt Moutai stock prices. Investors took Wen’s comments as a signal that less public money would be spent on liquor.

Per-bottle prices have declined as well. Some high-end brands of Moutai are now selling for 1,400 yuan a bottle, down from a peak of 2,000 yuan last year.

This pressure on prices has contributed to investor pessimism.

Some call Moutai “a corruption alcohol because of a hidden relationship between it and power,” an industry expert said. “Moutai’s high market price is due to a supply shortage, because normal market consumption is being suppressed by hidden consumption.”

Zhao Chen, a spirits industry researcher, told Caixin demand has been softened by the government’s fight against corruption as well as seasonal factors which contributed to high inventories early this year.

Other industry watchers say prices have come down because there are large quantities of counterfeit Moutai on the market in China. Their conclusion is based on what’s estimated to be about 30,000 tons of the brand’s baijiu on the market—nearly three times the company’s annual production.

Some observers say government control of the market has contributed to the high prices which encourage illegal production of fake Moutai.

A source close to the company said genuine Moutai is hard to get except through group purchases available only to “the army, government entities at the provincial level and above, and big SOEs such as China Mobile.”

The company also faces fierce competitive pressure from other brands of aged “jiangxiang” baijiu such as Langjiu and Luzhou Laojiao, as well as the “nongxiang” variety which accounts for 98 percent of the spirits in China and takes less than a year to produce, such as the popular brand Wuliangye.

Jiangxiang makers such as Tasly Group of Tianjin have been stepping up production in recent years. Tasly invested nearly 1 billion yuan in distilleries and cellars in Guizhou Province for its Guotai Jiangjiu brand, which has been selling well.

“Jiangxiang baijiu currently accounts for 30 to 40 percent of the high-end domestic market,” said Zhao. “There is lots of prospective business, especially in the business and government hospitality fields.”

He Chunmei is an intern reporter at Caixin.