A wise old cartoon turtle in Kung Fu Panda advises Po, the portly black and white star of the 2004 DreamWorks Animation blockbuster film, not to fret about honing his fighting skills, but rather to focus on the moment and do his best.

“Yesterday is history, tomorrow’s a mystery but today is a gift—that’s why it’s called the present,” says the turtle.

Hollywood studio executives might do well to heed this mantra when trying to gain further traction in China’s booming movie market. Hollywood films accounted for the lion’s share of the box office so far this year, but still face major obstacles as the Chinese Communist Party remains unpredictable in its regulation of the contest for entertainment industry profits. In continuing to limit Hollywood’s reach in China, the Party reveals an equally important part of its agenda—balancing the influx of foreign soft power influence over China’s citizen-consumers.

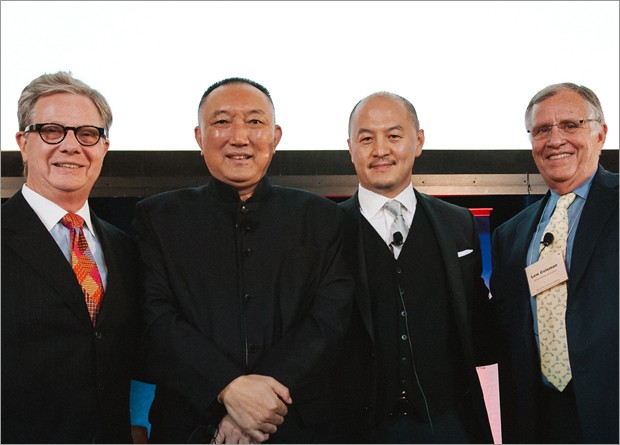

It was with that in mind that pan-Pacific movie makers gathered to read the latest tea leaves in Los Angeles on October 30 at an invitation-only dinner to watch a rare public exchange between two of the industry’s heaviest hitters, Lewis Coleman, president and chief financial officer of DreamWorks, and Han Sanping, president of the China Film Group, the nation’s monopoly film importer, leading distributor, and all-around industry heavyweight.

The Coleman-Han conversation, moderated to by longtime Pacific Rim film industry bridge-builder Peter Shiao, who urged the participants “to leave politics at the door,” followed a full afternoon of discussions between Hollywood and Chinese industry professionals at the third U.S.-China Film Summit, an event organized by the Asia Society of Southern California.

The event, held on the eve of the American Film Market, a bustling annual gathering of film buyers and sellers in nearby Santa Monica, drew hundreds of guests to an auditorium on the campus of the University of California, Los Angeles, to listen to a series of warm-up acts. Industry pros traded insights on the benefits and pitfalls of Sino-U.S. film co-productions, the increasing flow of screen talent between the two film industries, and Chinese investments in the U.S. entertainment business.

The mood of the day was cautiously upbeat. After all, China soon will become the world’s largest overseas consumer of tickets to big-budget American-made movies, and Coleman, with DreamWorks CEO Jeffrey Katzenberg, is planning to open the doors of the new $350 million joint venture animation studio Oriental DreamWorks in Shanghai early in 2013.

For his part, Han, who Shiao said had passed up a dinner invitation from Robert DeNiro to engage Coleman, arrived at their public chat to represent not just the Chinese film industry but also, it seemed, to give voice to a message China’s leaders would like the world to believe—that its media policies are driven as much by business as they are by politics.

Han has produced hundreds of films, including dozens from China’s best independent voices reflecting a rapidly changing China, modern classics such as Wang Xiaoshuai’s Beijing Bicycle and Zhang Yang’s Sunflower. Han also has made many films on an official front, including two of China’s most starkly nationalist, and commercially successful, films—the epic The Founding of a Republic, which grossed 430 million yuan (US$68 million) in 2008, and the less lucrative 2010 film The Founding of a Party.

As a China Film Group-produced video hagiography shown to event guests boasted, Han is in “the final stages” of getting the massive studio listed on a domestic stock market.

Han, who was appointed head of the China Film Group in 2007, is credited widely with pushing the studio toward the production of commercial entertainment in cooperation with expert international partners.

Cue James Cameron, as a surprise emcee to introduce Han. The Cameron Pace Group recently announced plans to open up shop in Tianjin, Beijing’s nearest port, so as to be able to lease its 3D camera technology and know-how to help the China Film Group make a documentary on the history of China’s capital.

“We look forward to supporting the great work that Han Sanping will continue to do and look forward to learning from him,” Cameron told the audience via a pre-recorded video. “The state of the Chinese film industry is a tribute to (Han’s) leadership and vision.”

The current King of Tinseltown had spoken. Han, smiling and looking like he felt he’d been sufficiently elevated in the minds of the audience—at least a few of whom had never heard of him—stood and, in a rare public appearance, delivered the message of the moment:

“China needs Hollywood and Hollywood needs China,” Han said, adding that the two film industries should “combine resources” to make “better treasures” for the world market.

When Han said he and Katzenberg had talked about Kung Fu Panda sequels “all the way up to No. 9” he painted a clear picture of just how much influence Han and China Film Group may try to exercise over the Oriental DreamWorks joint venture Katzenberg and Coleman set up with former Shanghai Media Group chairman Li Ruigang as its head.

Li, who unlike Han speaks English and was once a visiting scholar at Columbia University in New York, for years ruled the Shanghai Media Group as China’s second most powerful media conglomerate after state flagship broadcaster China Central Television. By the sound of Han’s remarks about how closely he and Katzenberg had discussed Oriental DreamWorks’ first outings, Li could be answering as much to Han as he will be working with the DreamWorks team.

After drawing considerable encouragement in February from the announcement of the U.S. China Film Agreement that opened China’s market to more U.S. films than ever before, many in Hollywood were dismayed to discover that their films were barred from distribution there over the summer as Beijing imposed a blackout that gave free rein to domestic films from companies such as the China Film Group. While CFG makes the bulk of its money in its role as the sole importer and lead distributor of super-popular Hollywood blockbusters, the company must also serve the people—and the Party—by showcasing Chinese-language films and films that send a Party-approved message. As a part of this balancing act, Han tried to be reassuring.

“After the 18th Party Congress,” which will announce China’s new top leaders on November 8, Han told the audience, “China’s media market will be more dynamic. China’s resources will serve your needs and you will make money in China.”

But the video clip Han showed next was puzzling. Taken from an early reel of a battle-heavy animated fantasy called NeZha, replete with dragons and other mythical Chinese beasts, it was a far cry from anything one could imagine DreamWorks wanting to produce.

It begged the question that underpins any discussion about international film industry cooperation: what sorts of stories are going to bring China and Hollywood together?

“This will take some time for both sides,” said Han, who, lest we forget, oversaw a partnership with Hollywood once before, working with Warner Brothers on a joint-venture with China Film Group that all but dissolved in 2007 after three years amid accusations the partnership had failed to make movies for China and instead made films for export that simply used the country as a backdrop and a source of exotic locations and cheap extras, films such as director John Curran’s Somerset Maugham adaptation The Painted Veil.

Since that time, China’s movie market has only grown. And fast. Some estimates now put the number of Chinese who pay as much as US$15 a ticket to go to the nation’s brand new digital multiplexes at about the same size as the entire U.S. population. China’s box office, which reached US$1.2 billion last year, is expected to grow another 30 percent this year and to out-gross the North American market by 2020.

Coleman said DreamWorks had no idea how important Kung Fu Panda would become. All his colleagues knew at the outset, he said, was that it was a great story and that China could no longer be ignored. After the first film, drawn from online research done at desks in Los Angeles, DreamWorks sent production designers on a tour of China to prepare the sequel. “The more we worked on Kung Fu Panda films, the more we learned about China,” Coleman said.

The success of the second film, which grossed US$93 million in China, also sparked a debate in China’s filmmaking community. “After all, here was an American company telling a very Chinese story that starred their national icon,” Coleman said. “Why weren’t these movies made in China?”

Coleman said DreamWorks asked a senior member of China’s media regulator, the State Administration of Radio, Film, and Television (SARFT): “Would SARFT have approved an animated film about a slovenly panda, which likes noodles much more than exercise, becomes a kung fu master, and has a goose for a father?”

“The SARFT official thought for a moment,” Coleman said. “Absolutely not,” was his reply.

But there were deeper reasons why this movie about a panda bear would not have been made in the country where panda bears come from, Coleman said.

DreamWorks was surprised, and pleased, to find that Chinese films tend not be directed at families but rather designed exclusively for kids or adults, but never both at once—a contrast with DreamWorks movies that Katzenberg is fond of saying are made “for adults and the adult in every child.”

Coleman also said China’s animation education system is focused on quantity, not quality, and is supported by prodigious state subsidies and a huge labor pool that helps it churn out cheap films fast.

“But the films that result tend to disappear just as quickly,” Coleman said. By contrast, DreamWorks typically takes four years to make each film, a process that has resulted in seventeen consecutive profitable outings, he said.

Finally, Coleman said that China’s regulatory system is “very focused on managing the details,” making it “very difficult for the creative process to breathe.”

In talks started about eighteen months ago, Coleman said DreamWorks began to try to help China’s film industry address all these shortcomings, particularly in animated film production.

“For this, we would be transforming DreamWorks Animation from an exporter of films to China into a China-based family brand that would create entertainment in China, for China and, importantly, (into) an exporter of Chinese culture to the rest of the world,” Coleman said.

Since the Oriental DreamWorks deal first was announced in February, some of the rapid change in China’s film industry appeared to have been put on hold with the distribution blackouts.

“The hardest thing about getting this deal done was the fact that it went so fast,” Coleman said. “I think we got caught up in a deal that had to go faster than either side wanted.”

What rushed DreamWorks into the deal first announced when China’s presumptive next leader, Xi Jinping, joined U.S. Vice President Joe Biden in Los Angeles in February? Coleman said the political change in China and noises from the country’s industry about wanting to open drove the deal to a head. “We all wound up running probably a lot faster than we should, and we all wound up wondering what the hell we did at the end of everything,” he said.

Coleman added, however, that Li Ruigang, Oriental DreamWorks’ lead man on the ground in Shanghai and CEO of China Media Capital, one of the three state-run investment funds behind the joint venture, was just the guy to realize the plan, one pegged closely to Beijing’s latest Five-Year Plan. On paper, that plan calls for the opening up of the media and a macroeconomic shift from manufacturing to consumption—consumption aided by spending on media and entertainment.

Han drove home the reassurances in a closing statement prior to rushing off (before dinner was served) to catch what moderator Shiao called a “private plane”:

“After the 18th Party Congress, reform and opening will continue,” Han said. “DreamWorks has opened a company in China. They’ll produce the films there, sell the films there, and make the profit there. It’s a very smart move, especially for animation companies. Entrepreneurs from the U.S. really have a vision and they will get something profound in their returns.”

Profits may be a lure for Hollywood, where domestic box office grossed dipped four percent last year, but pursuing the bottom line at the expense of creative freedom, expression bent to the will of China’s censors, moderator Shiao mused, must have generated some internal conversations at DreamWorks.

Coleman answered by saying he would “knock on wood” since no DreamWorks film that had played in China had been censored so far.

“We’ve had a few movies they’ve decided not to let in. And I don’t really consider that a form of censorship, I sort of consider that waiting in line for your turn,” Coleman said.

Looking forward five years, Coleman said he hoped that Oriental DreamWorks would look like “DreamWorks in China,” that it is “at least as large and at least as profitable” as DreamWorks in the United States.

The first film Coleman and Katzenberg will make in China is Kung Fu Panda 3, a co-production between Oriental DreamWorks and DreamWorks, set for release in 2016.

This could be a boon for DreamWorks in the U.S. After taxes and fees, the studio could take home forty-one to forty-two percent of Chinese gross sales, as compared to the twenty-five percent recoupable from a straight export, subject to the Chinese government’s annual cap of thirty-four films.

“More importantly for us, doing a co-production with Oriental DreamWorks is the best training program we could design,” Coleman said.

DreamWorks now has seven films in development in Los Angeles for Oriental DreamWorks. Not all of them will get made, Coleman said, but one or two may become the first films made completely at the company’s new Shanghai facility.

“These are very much Chinese stories. They are being developed by us because development skills are probably the one skill that is most lacking in China today—this and how you put together your story,” Coleman said.